Introduction

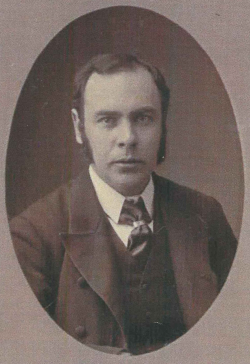

The picture of Sir Robert William Perks (1849-1934) that emerges from the present business history literature focuses on the fact that he was a solicitor, that he provided the services of a solicitor to a number of British railway companies from about 1880 onwards and that it was probably his skills in that work (particularly re parliamentary processes for Private Acts of Parliament) that led to Charles Tyson Yerkes appointing Perks as his British “lieutenant” in the major transformation of the London Transport system which Yerkes embarked upon from 1900.[1] It should be noted at this point that Perks also appears in the literatures of British religious history and of British political history. As a prominent Wesleyan Methodist layman, he worked in many significant roles in the governance of his church from the late 1870s onwards – culminating in his being elected the first vice president of the “organic union of the three larger Methodist Churches” in 1932.[2] Perks was a member of Parliament from 1892 to 1910. The literature cites his various work for Nonconformist causes (He was elected president of the Nonconformist Parliamentary Council at its inaugural meeting in May 1898, with Lloyd-George vice-president)[3]. The literature also cites Perks as a leading figure in the Liberal Imperialist Wing of the Liberal Party. Commenting on Beatrice Webb’s irritation about Rosebery having appointed as his first lieutenant a person she found such a “repulsive being” as Perks, Stephen Koss has written “Mrs. Webb, who was not alone in her disdain for Perks, nonetheless missed the essential point. It was not Rosebery who recruited Perks as first-lieutenant, but Perks who recruited Rosebery as captain.”[4]

A number of intriguing questions seem to be left unanswered in the existing business history literature on Perks’ career. Notably: was he really as wealthy as his contemporaries believed him to be? And if so, what were the sources of that wealth? In February 1894, the Methodist Times ran a profile-piece on “Mr R.W. Perks MP”, as number four of a “Methodist Public Men” series. The final sentence summary begins: “Wealthy, able, determined, a man of deep religious conviction and earnest purpose…”.[5] At about the same time this reference to his wealth appeared in print, Perks provided his contemporaries with a clear visible symbol by shifting his principal family residence from Lubbock Road, Chislehurst to 11 Kensington Palace Gardens. Since 1972 the residence of the French Ambassador (and prior to that the French Embassy building), this magnificent house had been built in 1852-53 for the merchant banker Don Cristobal de Murrietta.[6] When the Murriettas’ enterprise ran into severe difficulties in the wake of the Baring crisis, 11 Kensington Palace Gardens was put up for auction. The auction was held on 26 May 1892. The auctioneers described the property as “rated in the parish books at ₤1,200 a year”. The opening bid was ₤10,000, followed by further bids up to ₤13,000, at which the property was passed-in as not having reached the reserve price.[7] At some time during 1893 Perks appears to have bought 11 Kensington Palace Gardens. In 1894 he had a three-storey one-bay extension built.[8] And Dod’s Parliamentary Companion for 1894 records this as his residential address (the 1893 edition having recorded Chislehurst).[9]

In 1971, Mark Girouard had a two-part article on Kensington Palace Gardens published in Country Life, titled “Town Houses for the Wealthy” and “Gilded Preserves for the Rich”. He noted that only one aristocratic household lived in the street: “It was the richer of the new rich, without the desire or the social confidence to venture into aristocratic quarters who came to Palace Gardens”.[10] The same point is made in volume 37 of the Survey of London: “in general it was an aristocracy of wealth rather than birth that was attracted to the road, its social character being aptly summed up in the nickname ‘Millionaires’ Row’.”[11] When Perks moved into number 11, his new neighbours included: Sir Thomas Lucas, engineering contractor, who died March 1902 leaving ₤769,000; Baron Julius de Reuter, who died February 1899 leaving ₤262,604; Charles Frederick Huth; Samuel Montagu (created first Baron Swaythling 1907) who died January 1911, leaving ₤1,150,000; Gustav Christian Schwabe; Sir Alfred Hickman, who died March 1910 leaving ₤1 million; Sir Edward James Harland, who died December 1895 leaving ₤294,076; and so on.[12] While living in Kensington Palace Gardens, Perks maintained a substantial “holiday home” on the seafront at Littlestone in Kent. The architect Percy Burnell Tubbs (1868-1933) listed among his significant work “alterations and additions for the house of Mr R.W. Perks at Littlestone”.[13] In 1902, Perks bought a third residence to complete the trio of a townhouse, a holiday home and a country “seat”: Wykham Park on the outskirts of Banbury in Oxfordshire.[14]

It is the purchase of 11 Kensington Palace Gardens and the timing of that purchase, rather than Wykham Park, that is significant for the questions raised above, however. This purchase suggests that Perks was happy to be perceived as a person of substantial wealth by as early as the end of 1893/early 1894. And it suggests that he did not regard the “parliamentary practice” parts of his solicitor’s work to be the backbone of his income and wealth position. Upon entering the House of Commons in 1892, he had had to give up that part of his work. In 1895 he ceased doing any legal work for the Metropolitan Railway, the company which the entries for Perks in the DNB and DBB suggest was his principal source of income for the 15 years up to that point.[15]

It seems reasonable to conclude that although the ₤3,000 of income per year Perks received from the Metropolitan Railway, during the period he was supplying a full range of solicitor’s services (February 1882 to July 1892),[16] represented a very handsome flow of income, it would not have been sufficient, without major supplementation from other sources, to put him into the Kensington Palace Gardens “set” by the age of 42. There would seem to be two main potential candidates worth considering for the role as “source of major supplementary funds”, in a case such as Perks: significant wealth transfers via inheritance and/or marriage; or substantial flows of “other” business income (i.e. over and above “normal” solicitors’ fees income).

The next section of this paper presents a brief summary of what the writer’s researches have so far uncovered regarding the first of those two “potential candidates”. The conclusion, at this stage, is in the negative. No evidence has yet been found to indicate that Perks received sufficient injections of wealth-transfer monies to explain his apparent wealth status of the mid 1890s. Section three then focuses on Perks’ “other” business activities, with the word “other” being here used to denote business activities “other” than the provision of professional services as a solicitor, on a traditional “fee-for-service” basis. This section focuses on the period 1885 to 1902. The nature and extent of Perks’ business activities, as discussed in this section, may come as a surprise to readers who have become accustomed to seeing Perks described as a “railway lawyer” during the period prior to his taking on the role of Yerkes’s British right-hand man. The writer will be disappointed if that is not so! The paper’s final section provides concluding comments. These stress the difficulties involved in seeking to map the career of a businessman who was an “independent operator” and who left no substantial papers, and the risks to the progress of Business History if such difficulties/challenges are not grappled with.

II Wealth Transfers

R.W. Perks’ father was George Thomas Perks (1819-1877), who spent his entire adult life as a Wesleyan Methodist minister. When probate was granted on his will in May 1877, the estate was sworn: “Effects under ₤10,000; leaseholds”.[17] All of this estate was to be held in trust with the income going to G.T. Perks’s widow Mary during her life. At the widow’s death, three trusts of ₤1,500 each were to be established for Perks’s two unmarried sisters (Mary and Flora) and his younger brother George Dodds Perks, and the remainder was to be divided into two, with one half to R.W.Perks and the other half to his married sister Elizabeth Volckman. Perks’s mother died in March 1894,[18] so a portion of his father’s estate would have come into Perks’ hands at that time. As Perks’s unmarried sister Mary had died in March 1881, this portion would have been somewhat greater than in the formula summarized above. Upon the death of his mother, Perks also probably inherited some wealth in consequence of the trust that his mother’s father had established for her benefit. Perks’s mother had been an orphan when George Thomas Perks met her. Her father had, according to Perks, left her the income from “three or four of the finest houses in the Scottish capital”.[19]

As with the case of Perks’s flow of income from his supplying solicitors’ services to the Metropolitan Railway, the facts in the paragraph above are suggestive of “solid” middle-class status. But they do not take us much further in accounting for the decision by Perks to flag to his contemporaries in 1894 that he was of “Kensington Palace Gardens” wealth status. The same conclusion follows from examinations of whether Perks’ marriage might have brought him a significant injection of wealth, and whether inheritances from more distant members of the Perks’ family might have done so.

It is indisputable that Perks married into a wealthy family. In April 1878, Perks married Edith, the youngest of the four daughters of William Mewburn (1817-1900). When probate was granted on Mewburn’s will the gross value of his estate was sworn at ₤484,130.[20] The will, signed 11 April 1894, essentially divided the estate into six equal parts, with two going to the benefit of William Mewburn junior (born 1853), and one each to the benefit of the four daughters. In each case the “benefit” was an income-stream benefit, with the capital largely constrained to be preserved for the benefit of the subsequent generation. But perhaps the most interesting feature of Mewburn’s will for the concerns of this paper is the fact that it specifically cites marriage-settlement monies of ₤5,000 and ₤2,000 made by Mewburn to his son and to his daughter Eliza[21] respectively – with the instruction that adjustment for these monies “should be brought into hotchpot”, for purposes of dividing the estate into sixths upon Mewburn’s death. This would seem to suggest that no significant marriage-settlement was made in respect of Edith’s marriage to Perks in April 1878. There may of course have been other inter-vivos capital transfers made by Mewburn to all five of his heirs, on a basis that he deemed to be fair as between them, and which are not therefore referred to in the will. But in the absence of further evidence, it would seem reasonable to infer that no substantial marriage settlement monies passed into Perks’ effective control at the time of his marriage in 1878. And in 1894 Perks was still six years short of receiving any immediate cash-flow benefit from his wife’s status as a significant beneficiary in a very wealthy man’s will. Perks’ marriage almost certainly gave him the advantage of a sympathetic hearing, when he sought “partner” funds for his projected business ventures from a wealthy father-in-law, wealthy brothers-in-law and the various contacts available through those. This may have been a key factor in accounting for Perks’ wealth-status by 1894. Direct capital-transfer from the Mewburns, or even early anticipation effects associated therewith, would seem unlikely to have played more than a subsidiary role.

Perks’s mother Mary had only one sibling, a sister Isabella who apparently died some years before Mary met Perks’ father.[22] At this stage it has not proved possible to identify any other “maternal-side” relatives who may have been possible sources of inheritance-funds to Perks. Perks’s father had three siblings.[23] The older of his two brothers spent some time working in commerce in Britain before studying at Kings College London and becoming an Anglican clergyman in Australia in 1851.[24] Perks reports that this uncle invested profitably in Australian Mining[25], and Australian sources suggest that he lived the life of a man with more income than provided as income by his Church,[26] but when he died in February 1894 his estate was sworn at ₤2,441 and passed entirely to his widow.[27] Perks’s second uncle, William, ran what appears to have been a modest electroplating business in Coleshill Street, Birmingham.[28] William died in April 1913, and had one son and five daughters of his own to leave money to provide for.[29] Perks’s father’s only sister Rebecca married Samuel Griffiths of Wolverhampton.[30] Griffiths had a “colourful” business career which included many highs and many lows (including at least three bankruptcies). Frank Sharman has outlined Sam Griffiths’ career in a sequence of web pages for the Wolverhampton local history society. Sam Griffiths died in May 1881 leaving ₤395, all to his third wife Emma.[31]

Perks’s grandfather William (1781-1831) had a number of first cousins who lived in Wolverhampton or Birmingham. Among these cousins there were two brothers (William and John) who married two sisters from the Hartley family of glass manufacturers (Jane and Louisa, in January 1836 and June 1837 respectively). By this date the Wolverhampton branch of the Perks family had become well-established as manufacturers of “edge-tools” in Wolverhampton.[32] A half-sister of these two Hartley sisters had married the Wesleyan Methodist minister Joseph Fowler, and their son was Henry Hartley Fowler (1830-1911), who became Lord Wolverhampton in 1908.[33] This family relationship undoubtedly formed the basis for H.H. Fowler accepting in late 1875 the very young (aged 26), and newly-qualified R.W. Perks as a partner in his well-established solicitors’ practice (Corser and Fowler) and in his willingness to endorse the establishment of a new London office for the firm (at 147 Leadenhall St), at which R.W. Perks would be the main functioning partner.[34]

But H.H. Fowler’s acceptance of a partnership arrangement with R.W. Perks in late 1875 seems to have the properties of providing a relative with an opportunity to perform, rather than the properties of a significant wealth transfer. This seems also to be the case with Perks’s interactions with his other wealthy Perks relatives during the formative stages of his career. The wealthiest of the Perks family of Wolverhamption-Birmingham was John Perks (1797-1875), who had married Louisa Hartley. He left ₤120,000.[35] None of that money went to R.W. Perks. But the youngest of John’s sons (John Hartley Perks) soon went into property-development partnership arrangements with R.W. Perks (see below). Among all the members of the Wolverhamption-Birmingham Perks family, the largest wealth-transfer to R.W. Perks that has been identified by the writer at this stage is from the will of George Perks (1824-92),[36] son of William who had married Jane Hartley. He had married in 1868 Maria, one of the daughters and heiresses of Joseph Gillott, the famous steel-pen manufacturer who died in 1872 leaving ₤250,000.[37] George and Maria believed they were being treated unfairly under the will. They launched a Chancery case through R.W. Perks in June 1875 (two months after he had qualified as a solicitor). This Chancery case triggered proceedings which continued until 1916.[38] George Perks’s will indicates that R.W. Perks had been managing his property interests during his lifetime and instructs that he should continue to do so for purposes of his estate. George Perks bequeathed ₤1,000 plus “two diamond and ruby studs” to R.W. Perks; and “my diamond ring, three diamond studs and my signet ring” to George Dodds Perks.[39]

The dimension of this bequest to Perks from his cousin George is undoubtedly handsome. But, taken alone, or in combination with other identified inheritances (and equivalent wealth-transfers), it is insufficient to explain how Perks came to be viewed by his contemporaries as such a wealthy man by the mid 1890s. This is the largest bequest that has so far been identified in the present writer’s research into the wider family connections of R.W. Perks. One must continue to regard this question as “open”, until all family connections have been checked. But at this stage, the available evidence suggests that R.W. Perks did not establish Kensington Palace Gardens “wealth status” for himself by 1893-94 primarily on the basis of receiving bequest or marriage-settlement monies.

III Business Activities prior to London Underground Electrification

There appear to be three main strands to Perks’ business activities during the 1880s and 1890s. One is property development activity. A second is work on company formations and the raising of finance for companies. And the third is Perks’s activities in association with the public works contractor Thomas Andrew Walker up to Walker’s illness and death in 1889, and in association with the successor-entities to the T.A. Walker enterprise after Walker’s death. It was this third strand which Perks’s entries in various successive editions of Who’s Who tended to stress, along with his work as solicitor for the Metropolitan Railway. It is interesting to examine what information can be found on the first two strands, and to consider how those of Perks’s activities interacted with his “T.A. Walker” activities.

Perks’s first venture into the company financing field appears to have been the Lydd Railway in Kent. The company was incorporated by Act of Parliament on 8 April 1881. The Appledore-Lydd-Dungeness section was constructed rapidly and opened on 7 December 1881. In July 1882 Parliamentary authorization was obtained for a branch eastwards to New Romney and that section was opened 19 June 1884.[40] New Romney adjoins Littlestone-on-Sea, where Perks built his holiday-home and where

he became engaged in property development activities which are discussed below. In Perks’s Notes for an Autobiography, almost three pages are devoted to this project (pp 67-69) and it is stated: “The necessary capital for carrying out these transactions was provided, one third by my father-in-law, Mr Mewburn, one third by me, and one third by the firm of Mewburn and Barker, Stockbrokers, of Manchester.” (p 69). This sentence greatly exaggerates Perks’ own contribution to the “putting up of money”, but simultaneously downplays his role in both putting together a “financing package” for the Lydd railway, and then working to ensure that the project was carried out to the satisfaction of his financial partners.

The capital required for the Appledore-Lydd-Dungeness section was ₤100,000, of which ₤75,000 was to be in ordinary shares of ₤10 each and ₤25,000 was in 4 ¼ per cent debentures. The South-Eastern Railway, of which William Mewburn senior was one of the largest shareholders and a director, agreed to contribute 55 per cent of both the ordinary capital and the debenture capital. The South-Eastern also agreed to operate the railway, once it was built, and to guarantee a 4 ¼ per cent return on both the debentures and the ordinary shares from that point. Of the 45 per cent of the Lydd Railway’s ordinary share capital subscribed by Perks’s family syndicate, 100 shares were in the sole name of Perks’s brother-in-law John Lees Barker and the remaining 3275 were in the joint names of Perks, Barker and William Mewburn junior. So Perks does appear to have contributed approximately one-third of the family syndicate’s contribution towards the ordinary share capital of the company. Some of this contribution no doubt took the form of his accepting scrip as remuneration for legal work on the Company’s Act (the total of Parliamentary and preliminary promotion costs was ₤10,402), and for legal work on land purchases and compensation arrangements. Between 7 February 1882 and 13 May 1882, the joint family parcel of 3,275 shares was disposed of in stages, and from the latter date Perks ceased to have a shareholding in the railway – although John Lees Barker continued to hold 305 shares, William Mewburn junior 305, and Mewburn senior 1,125. Of the 45 percent of the Railway’s debenture capital subscribed by Perks ‘ family syndicate, ₤1,000 was in Perks’ name, compared with ₤3,750 each from Barker and Mewburn senior and ₤2,750 from Mewburn junior. Perks disposed of his debenture holding on 23 March 1882, although his three family partners continued to hold their debentures until at least 1886.[41]

The 4 ¼ per cent guarantee from the South-Eastern meant that the main risks the Perks family syndicate members were exposing themselves to, in joining into the venture, related to cost overruns in land purchase arrangements or in the railway’s construction, and/or time-delays in these matters. Perks managed the land purchase arrangements himself (indeed it was not until October 1882 that the various properties were transferred from the joint names of Mewburn, Barker and Perks into formal legal title in the name of the Railway).[42] Perks secured the services of T.A. Walker to construct the line and this was done rapidly without cost over-run. In terms of “putting his own money” into this project, Perks’ contribution was considerably smaller than that of each of his family member partners. This suggests that in 1880-1882, he was still some distance away from a house in Kensington Palace Gardens. But the skills Perks showed in negotiating the financing package for this project, and then providing oversight until the railway was in operation (and earning the South Eastern guarantee money) may well have paved the way for his finding willing partners for future financing projects.

If Sir Edward Watkin’s plans for a dock at Dungeness; cross-channel services from there to Treport, and a direct railway link to Appledore from London had gone ahead, ordinary shares in the Lydd Railway would probably have risen in price above the value implied by a capitalization of the South-Eastern’s dividend guarantee. That did not happen, and in January 1895 the Lydd company was absorbed into the South-Eastern, with preference shares in the latter issued in exchange for the ordinary shares in the former.[43] So although Perks’ success with the financing package for the Lydd Railway no doubt won him kudos within his personal circle, it was not the stuff to make a wider public reputation for financial acumen. That wider and more public reputation was achieved by Perks’s involvement in a major financing project for the Barry Dock and Railway Company in 1887.

Perks does not appear to have been involved in the original promotion of the Barry Company or in its initial capital raising in 1884. In September 1884, the company (authorized capital ₤1,050,000) issued a prospectus inviting subscriptions for ₤10 ordinary shares stating “the directors and their friends have subscribed for the larger part of the capital”.[44] The total initial share allocation was ₤595,050, all in ordinary shares. Perks’ involvement was triggered by the company running into difficulties raising additional capital needed to complete the project, and by the fact that T.A. Walker had in October 1884 won the major contract to construct the Dock (and part of the railway).[45] Perks in Notes for an Autobiography states: “The contributions of the Ordinary Shareholders became exhausted and large sums were due to the Company’s Bankers. The Directors decided to raise further capital. Their own resources available for outside investment were exhausted and the Bankers refused to lend more. Mr Walker advised the Directors to see me.” (p 100). By the time Perks was approached (in his London office by the Company’s Deputy Chairman, David Davies) the Board had decided on an issue of ₤500,000 of 5 per cent preference shares. Parliamentary authorization had been obtained for the “cancellation” of the company’s un-issued ordinary shares, with the equivalent capital to be raised by prefs, and also for the raising of ₤140,000 additional capital by preference shares.[46]

On 27 April 1887, Perks attended the Board of Directors meeting of the Barry company in Cardiff.[47] The Board minutes record the Deputy Chairman informing Perks that “the Board had decided only to offer Mr Perks’ client ₤300,000 worth of preference shares at par” which suggests that Perks had offered to take more. The minutes also record that ₤279,000 of prefs were subscribed for “in the room”, i.e. by directors and (through them) their friends. David Davies and friends subscribed for ₤140,000. At the Barry Board meeting of 13 May 1887, it was reported that “Mr Perks had agreed to accept ₤220,000 of preference shares or stock on behalf of Mr Mewburn and others”.[48] The arithmetic suggests Perks wanted the overall size of this preference share issue kept down to that in the original proposal. An interesting sidelight is cast on the above by the Board minutes of the Star Life Assurance Company, now in the archives of the Eagle-Star company in Cheltenham. The Star Life Assurance Company had been established in 1843 by Wesleyan Methodists. In 1887, William Mewburn senior was deputy chairman of the Star, and Henry Hartley Fowler (legal partner of Perks from 1875 to 1900) was a director.[49]

On 25 May 1887, the Board of the Star discussed a letter from Perks applying for an advance of ₤90,000 to David Davies (at 4 ½ per cent interest) to be secured on ₤90,000 5 per cent preference shares. A letter in the Barry Dock and Railway Company papers at the PRO from Perks to David Davies dated 3 November 1887 is headed “Yourself and Star”, and indicates the names of the 4 trustees of the Star to whom the shares to be security for the loan (a mixture of Barry and Pembroke prefs) should be transferred.[50]

In Notes for an Autobiography, Perks states that Davies agreed that a half per cent commission would be payable on Barry prefs placed at par through Perks. A paragraph follows in which Perks indicates he had strong reasons for believing Davies could be haggled-down to an issue price well below par for the 5 per cent prefs (97 is mentioned). Perks then continues: “Believing, however, as I did, that the project was sound, and that the Directors were efficient men, already deeply interested in the success of the Docks, I advised my friends to purchase the stock at par.” (p 101). Perks does not disclose that his “financing package” for the Barry Company involved him helping the Directors of the company to become yet more “deeply interested” in the success of the Docks. Nor does Perks disclose that the package involved him becoming a director of the company. The fact that he was a director of the company from the middle of 1887 to 24 July 1890, and that this was his first directorship of a significant public company, is not mentioned in Crane’s biography, Perks’ Notes for an Autobiography, or any of the other main sources on Perks’ career

At the same time that Perks became a director of the Barry company (at the age of 38), Louis Gueret joined the board.[51] A partner in L & H Gueret, Coal Shippers from Cardiff, it is possible that his appointment to the Board was part of the conditions in Perks’s proposed “financial package”, and that Gueret’s firm participated in the Perks’ group which took up ₤220,000 Barry prefs. But at this stage nothing has been found to support (or confound) that hypothesis. What is more certain is that the Perks’ “financial package” provided the finance necessary to complete the Barry project. On 29 June 1889 water was let into the dock, and on 18 July 1889 both dock and railway were opened for traffic. The company’s shares had been traded on the Cardiff stock exchange since the end of 1884. But on 29 January 1889 the company applied for a Special Settlement Day (SSD) and Official Quotation on the London Stock Exchange. From the Stock Exchange records it is clear that Perks had the job of managing this process of obtaining a London Stock Exchange listing. On 23 January 1889 it was Perks who wrote, on the company’s behalf, but on his 9 Clements Lane letterhead, to Alexander Henderson (of Messrs Greenwood and Co.) authorizing him to apply for an official quotation of the Barry company’s shares on the London Stock Exchange.[52] Perks would have had previous contact with Alexander Henderson regarding the Stock Exchange quotation of securities in the Buenos Ayres Harbour Works Trust, which played an important part in the financing arrangements for T.A. Walker’s work on the construction of port facilities in Buenos Aires.[53] From early 1891, Alexander Henderson was associated with Perks in the “Dredging and Barge Company Ltd” (see the company at entry 9 in Appendix A).

The Barry company’s application for official quotation on the London Stock Exchange ran into problems arising from the numbering system for the shares, which had apparently been acceptable to the Cardiff exchange despite the fact that: “Some numbers appeared no less than three times over, and there were three separate sets of certificates.” Perks and Henderson overcame these problems by making arrangements for the company’s ordinary and preference shares to be converted into “stock”. An SSD was finally approved for 15 October 1889.[54] With the greater liquidity of a London quotation, and with the dock and railway business prospering, the Barry shares soon rose to high prices. At the Barry’s Board meeting of 21 March 1890 it was reported that prefs held by the Perks group were available for sale and were to be offered to Barry shareholders at 120% and then via Messrs Thackeray and Lyddon at not less than 121 (with a commission of 1 per cent to them).[55] The Crane biography states that “in dealing in the paper of [the Barry company], he is said to have made a little fortune.”[56] In Notes for an Autobiography, Perks states more modestly that the company’s stock: “rose rapidly to a very high premium, at which my relatives and I, later on, sold our Stock” (p 102).

What we seem to see with Perks “financial package” for the Barry company in 1887 is in many respects a “scaled-up” version of his Lydd Railway project, as far as what he is offering his partner-investors is concerned. He assures that he will put in his own skills and time to ensure that cost overruns, and timing delays on the project do not spoil its economic fundamentals. In this case the economic fundamentals are the key market forces rather than a South-Eastern Railway guarantee, and Perks must have been able to convince his partner-investors that his assessment of those key market forces was sound. To do so in this case would clearly have needed input from persons with direct experience in the business of coal-mining and coal-exporting from the UK. Perks’ brother-in-law Mark Oldroyd had coal interests in the Yorkshire-Nottinghamshire-Derbyshire Coalfield.[57] Perks’ mentor Edward Watkin had substantial knowledge in this area as a result of the business in exporting coal via Grimsby.[58] Whatever the sources of information were, at the end of the day it paid off. Persons who committed capital funds to Perks’s 1887 financial project for the Barry Railway could see fairly immediately that they were well in front.

The success of the Barry project became a major and continuing advertisement for Perks’s business skills. Perks gave sworn evidence before the House of Lords committee on the Llanelly Harbour and Portdulias Railway Bill on 2 May 1899. Asked: “you have very large experience in the placing of the issues made by various railway companies in South Wales and elsewhere?” Perks answered “Yes, I have had a great deal of experience.”[59] Further questions allowed Perks to provide more detail: “I had a great deal to do with the letting of the stock of the Barry Railway in its early inception when it was refused in London, and my friends and I took a very large quantity of stock at par, which went to a very large premium”.[60]

As the engineering work on the dock and railway at Barry neared completion, Perks registered a company whose principal activity was to be property development on Barry Island (which continued to be known as “Barry Island” although the dock project had effectively converted it into a ‘peninsula’). The Barry Estate Company Limited was registered in April 1889 by Perks’s legal firm, then styled “Fowler, Perks, Hopkinson and Co.” and had an authorized capital of ₤50,000. Appendix A provides brief descriptions of all Companies Act companies so far identified as having been registered by the Fowler-Perks legal firm from 1885 to 1902, together with equivalent information on statutory companies whose published prospectuses cited a connection with the Fowler-Perks firm.

It is somewhat intriguing that neither the Crane biography nor Perks’ Notes for an Autobiography, make any mention of Hopkinson having been a partner in the Fowler-Perks firm.[61] Henry Lennox Hopkinson (1855-1936) qualified as a solicitor in July 1881 and was a partner in the firm Fowler, Perks, Hopkinson and Co. from 1887 to 1894. He had worked with Fowler and Perks at their 147 Leadenhall Street premises from 1884, but appears not to have had partnership status until the firm relocated to 9 Clement’s Lane, Lombard Street in 1887.[62] Hopkinson’s departure from the firm in 1895 appears to have coincided with Perks’ younger brother George Dodds Perks becoming a partner.[63] Henry Lennox Hopkinson was the son of General Henry Hopkinson (1820-1899) who was throughout the 1880s and 1890s a director of the Railway Debenture Trust Company Limited and the Railway Share Trust Company Limited (the latter was renamed the Railway Share Trust and Agency Company Limited in 1890).[64] In 1890 and for parts of the surrounding period, Perks had two other legal partners: Edgar Watkin, a nephew of Sir Edward Watkin, and James Heald – later described as “a considerable landowner about Didsbury [in Lancashire].”[65]

Returning to the Barry Estate Company, Perks, Hopkinson and T.A. Walker were among the initial seven subscribers. And of the five initial directors three were Perks, T.A. Walker and John Cory.[66] Cory (1827-1910) was a director of the Barry Dock and Railway Company, a colliery-owner, coal-shipper and ship-owner residing at Vaindee Hall near Cardiff. At his death, his estate was valued at ₤799,000.[67] The other two initial directors were A. McNab and L.W. Williams[68], regarding neither of whom the writer has yet succeeded in obtaining any further information. The company appears to have been dissolved at some point in the late 1950s and no records have survived via the BT31 Series at the PRO. What little we do know about the company’s activities comes from the records of a successor company “Barry Estate Holdings Ltd”, registered in May 1957. This company was dissolved in 1986 but the microfiches of its filings with Companies House are still available in Cardiff. (Company No. 00583579). The information on the 1957 “takeover” indicates that Cory (or his heirs) must have exited from the company at some stage – the shareholdings in 1957 being approximately 60 per cent T.A. Walker family-members and 40 per cent Perks family-members. The asset-portfolio suggests that the company had concentrated on residential property-development and commercial properties of the residential-amenity-providing type (as distinct from forming part of the Island’s rail and dock commercial complex). It is at this stage mere conjecture, but it is possible that the land developed by the Barry Estate Company from 1889 was land that the Barry Dock and Railway Company had needed to own during the construction phase of the project, but which was destined to become “surplus land” in 1889, and which it had been arranged would be transferred to T.A. Walker (and possibly Perks) as payment-in-kind (in lieu of obligated cash) for services being provided to the company. Under the circumstances of the Barry company’s controlling shareholders’ liquidity problems of early 1887 (see above), if Perks had spotted and suggested this possibility towards ameliorating the situation, that would have added to the attractiveness of his 1887 “financing package” for the company. Perks and Walker, in a position to have greater confidence in the completion timetable for the dock, may have been willing to commit to better price-terms for the “surplus-land” than alternative buyers.

Returning from conjecture to verifiable fact, the Fowler-Perks legal firm took part in the promotion and flotation of three major South Wales Colliery companies between May 1890 and April 1891. These were: D. Davis and Sons Limited; The Penrikyber Navigation Colliery Company Ltd; and The Albion Steam Coal Company Ltd (see companies at entries 6, 7 and 10 in Appendix A). The total capital sought in these three public offerings exceeded ₤1 million. In all three we can see a combination of the Fowler-Perks legal firm, the Mewburn and Barker stockbroking firm of Manchester and the London broker W.H.L. Barnett and Co. During this same period, there was also an attempt to raise capital for the Vale of Glamorgan Railway Company (see entry 8 in Appendix A), in the prospectus of which the names of those same three parties were prominent. This railway was to be a “coal” railway, that would benefit a group of new colliery developments and simultaneously increase the flow of coal onto the Barry system. There was an agreement for it to be worked by the Barry Company “in perpetuity”.[69] The initial public offer was not a success, but once the Barry Company obtained Parliamentary authorization to provide a guarantee of 4 per cent on the Vale of Glamorgan dividend, sufficient capital was raised to enable construction to go ahead (See Appendix A).

Perks was involved in the formation of a further South Wales based company in March 1892: Thomas Owen and Company, Limited (see entry 13 in Appendix A). This company was formed to take over the ownership and operation of the Ely Paper Works in Cardiff from its erstwhile owner Thomas Owen.[70] Thomas Owen (1840-1898) was a prominent Wesleyan Methodist (one of that church’s 35 lay delegates to the Second Ecumenical Conference in Washington DC in October 1891),[71] Chairman of the Bath Paper Works Company Limited and Evans & Owen (Limited), based in Bath, and brother of Owen Owen the department store owner. He was MP (Liberal) for Launceston from 1892 until his death.[72] During the first three years of the company Thomas Owen and his family retained ownership of over 65 per cent of the ordinary share capital and over 80 per cent of the preferred capital.[73] The main contributors of capital from outside the Owen family were Perks, John Cory (director of the Barry Dock and Railway Company, the Vale of Glamorgan Railway Company, the Penrikyber Colliery company and the Barry Estate Company Ltd) and Thomas Anthony Denny of 7 Connaught Place, Paddington, London. Philip Morel (a Cardiff shipowner and director of the Albion Colliery Company) became a founder director, but held only the shareholding necessary to qualify to be a director (50). T.A. Denny was represented on the board by his son G.A. Denny (who held just the “qualification” 50 shares).[74] In 1895 the company expanded by purchasing a sulphite paper mill in Sweden, and raising additional share capital including via a public issue of preference shares (see Appendix A). The ordinaries remained tightly held. Perks continued on the company’s Board until 1909, and succeeded Thomas Owen as chairman when the latter died in July 1898. Up to and including 1897 the company paid regular dividends of 12 ½ per cent on its ordinary shares, but then went through a less prosperous period with only the pref. dividend paid in 1898 and 1899.[75] It would appear that Perks was happy to take responsibility for overseeing the company’s progress through this difficult period, before handing over the chair to Charles Todd Owen, the elder son of Thomas Owen, who had been 28 years old when his father died. While his father was still alive, C.T. Owen became associated in the financing of two West African gold exploration-and-mining companies promoted by the Fowler-Perks firm (see entries 17 and 20 in Appendix A). Neither Thomas Owen, his family nor the Thomas Owen paper-making company receive any mention in either the Crane biography or Perks’ Notes for an Autobiography.

The Dredging and Barge Company Limited (see entry 9 in Appendix A) is of particular interest because it is the only one of these early Fowler-Perks company promotions to be specifically named in Perks’ biographical entries in Dod’s Parliamentary Companion. Perks’s entry in the Dod’s edition for the New Parliament in 1892 begins with a sentence stating he is a solicitor in partnership with H.H. Fowler in London, “and in Manchester alone”. The next two sentences read: “Has special business in railways, docks, and public works at home and abroad. Is an Associate of the Institute of Civil Engineers, solicitor to the Metropolitan Railway, chairman of the Barge and Dredging Company (sic) and a director of various other companies”. The fourth and final sentence of the entry summarizes Perks’ political views, followed by information on clubs and addresses.[76] The 1893 Dod’s entry reads exactly as above. The 1894 and 1895 entries pair information on Perks’ partnership with Thomas Owen in the Ely Paper Works with his being “a proprietor and chairman of the Barge and Dredging Company” (still not described by its true legal name). The 1896 entry deletes both the reference to the Ely Paper Works and that to the Barge and Dredging Company.[77] The Directory of Directors for these years does not cite Perks as being a director of this company. The Stock Exchange Yearbook makes no mention of this company. A BT 31 file on this company exists at the PRO. This tells us who its shareholders were (see Appendix A), but not who its other directors were, or what it actually did with its ₤42,800 of called-up capital between January 1891 and wind-up in late 1894/early 1895.

Yet Perks chose to give his chairmanship of this company particular prominence in Dod’s. The timing of the company’s registration and the nature of the activities authorized in its memorandum of association suggest that the company was formed in conjunction with the settlement of a dispute between the Manchester Ship Canal (MSC) Company and the executors of the TA Walker estate. This was in regard to plant and equipment that the MSC Company had provided up-front money for the initial purchase of, but which the TA Walker enterprise was expected, under the original contract, to gradually buy-back from the MSC (using money from the progress payments received from the MSC Company for work satisfactorily carried out on the canal construction). The total outlay on plant and equipment by the MSC Company on this basis had been ₤943,610. By November 1890, ₤195,000 of this had been recovered from the Walker enterprise.[78] The Financial Times of 3 February 1891 (p 2) stated in regard of the half-yearly general meeting of the MSC Company to be held that day: “On the Manchester Stock Exchange there has been a good deal of promiscuous talk about sensational disclosures impending.” The company’s report, released the preceding evening, did in fact disclose that a settlement had been reached between the company and the TA Walker executors, and had gone into effect on 24 November 1890 (i.e. ten weeks earlier). Under this settlement “the executors of the contractor and the executors’ staff, under the management of Mr Topham, are to act as the agents of the company.”[79] The Walker executors agreed to handle the “realisation” of the plant and equipment, upon completion of the canal, with 40 per cent of the proceeds in excess of ₤450,000 to go to the executors.[80] Perks attended the MSC Company’s meeting and was referred to in comments from the Chair as “the legal advisor of the executors”.[81] Perks later spoke in favour of a vote of thanks to the chairman and directors of the company.[82]

Of the Dredging and Barge Company’s share-capital, 68 per cent was held by Perks and his brother-in-law John Lees Barker. The other significant shareholders were: the London and River Plate Bank Ltd (12 per cent); Alexander Henderson and his partners in the London stock-broking firm Greenwood and Co. (6 per cent); W.H. Topham (5 per cent); and Alfred Spalding Harvey, secretary of Glyn, Mills, Curry and Company’s Bank (7 per cent).[83] Alexander Henderson (1850-1934) was a director of the Manchester Ship Canal Company from 1890 to 1896.[84] In 1887 he acted for the Buenos Ayres Harbour Works Trust in regard to their application to the London Stock Exchange for a Special Settlement Day and official quotation for the ₤800,000 of that entities “trust certificates”.[85] A public offer of those certificates had been made in March 1887 by the London and River Plate Bank Ltd.[86] The purpose of the Trust was to provide finance to the contactor constructing the harbour works (T.A. Walker) during the period before sections were completed to the satisfaction of the Argentine Government and that government’s progress payments made.[87] The Manchester Ship Canal was opened to traffic on 1 January 1894 (and “officially opened” by Queen Victoria on May 21).[88] The move towards winding-up the Dredging and Barge Company later that year is further circumstantial evidence linking that company to the plant and equipment used in the construction of the Manchester Ship Canal.

In mid-1892 Perks was involved in two company flotations which were much higher profile than any of the preceding 13 “Fowler-Perks companies” listed in Appendix A. These were A and F Pears Limited – the maker and marketer of Pears soaps, and the Lancashire, Derbyshire and East Coast Railway – originally conceived of as 170 miles of line connecting collieries in the East-Midlands with new purpose-built coal ports on both coasts (at Sutton-on-Sea on the Lincolnshire coast, and Warrington on the Manchester Ship Canal).[89]

The day before it carried the Pears prospectus, the Financial Times stated: “At last, after many false alarms and premature announcements, Pears’ Soap has been transferred to a joint stock company. Despite the title of one of the firm’s most popular advertisements, A and F Pears Ltd. is not likely to be ranked as one of the ‘Bubbles’ of the century; rather will the investor rush for an allotment of the shares and not be happy till he gets it. The company has been registered by Fowler, Perks and Co. …”.[90] That was clearly good publicity for Fowler-Perks as well as for the impending prospectus. The prospectus provided the four most recent years’ profit figures for the undertaking and cited agreements by T.J. Barratt to continue to chair and administer the business for at least five years. The Board was to include Frederick Gordon, chair of Gordon Hotels. Perks was to be one of the three trustees for the company’s debenture holders (see entry 14 in Appendix A). The public offer appears to have been heavily oversubscribed. Those fortunate enough to receive allocations of shares were immediately sitting on healthy gains. This included Perks himself who was the second largest holder of ordinaries after Andrew Pears, immediately following the float. Perks divested half of this holding by a year later.[91] T.J. Barratt, Andrew Pears and Frederick Gordon later joined with Perks as substantial shareholders in the Khedivial Mail Steamship and Graving Dock Company Limited (see entry 22 in Appendix A).

The float of the Lancashire Derbyshire and East Coast (LD&EC) Railway did not meet with the same success as the Pears float. Only a little more than one-tenth of the shares offered were allotted (see entry 15 in Appendix A for the figures), and in 1893 the company issued a writ against one of its directors Lord Francis Pelham-Clinton Hope for failure to pay calls on the 16,000 shares allotted to him. Dow states: “The default put the LD&EC in some difficulty until a group headed by R.W. Perks … came on the scene.[92] In essence Perks negotiated a rescue package for the LD&EC that involved three main elements: substantial new capital would be injected into the company (₤850,000 from the company’s pre-existing directorate and their friends, ₤250,000 from the Great Eastern Railway, and ₤250,000 from Perks and his group); there would be four new directors, two nominated by the Great Eastern plus Perks and his brother-in-law Mark Oldroyd; and the proposed extent of the railway was drastically scaled back (the planned section west of Chesterfield to be abandoned and the planned section east of Lincoln to be devolved into a separate corporate entity, the Lincoln and East Coast Railway and Dock Company). The main features of this package were made public at the LD&EC’s ordinary general meeting held on 29 August 1894. The Times reported the ₤250,000 capital injection “by an influential body of capitalists who would be represented on the directorate by Mr R.W. Perks MP and Mr Mark Oldroyd MP”.[93] In a recent detailed study of the LD & EC Railway, David Wilmot has described Perks as “a man whose impact upon the development of the LD & ECR has been under-rated by earlier historians… Perks applied a stringent condition to his agreement to contribute, namely the abandonment of the section west of Chesterfield, and the GER tied its own acceptance of the Perks financial arrangement to the completion of its own agreement to finance the LD&ECR”.[94]

Wilmot’s researches have uncovered the names of most of the members of the Perks’ 1894 group of subscribers to the LD&EC[95], and also the fact that ₤205,000 of the ordinary shares they took up were “to have the first call for conversion to debentures upon Parliament’s approval of borrowing powers”.[96] The biggest contributor among the Perks group was Perks’s father-in-law William Mewburn (₤50,000), followed by: brother-in-law Mark Oldroyd; John Cory (director of Barry Railway, Vale of Glamorgan Railway, Barry Estate Company, Penrikyber Colliery and an initial subscriber to the Thomas Owen Company); Perks himself; brothers-in-law John Lees Barker and William Mewburn junior (joint holding); Frederick Lewis Davis (chairman of D. Davies and Sons, Limited, Ferndale Steam Coal Collieries – see entry 6 in Appendix A – and director of Barry Railway, and Vale of Glamorgan Railway); and Thomas Anthony Denny (the third biggest holder of ordinary shares in the Thomas Owen Company and the second biggest holder of its prefs). Among the smaller contributors in the Perks group was the Rev. Walford Green, one of the initial directors (alongside Perks) of The Queens College, Taunton, Limited (see entry two in Appendix A), and later to become a treasurer in Perks’ project to raise a million guineas for the Wesleyan Methodist Church.[97] Wilmot speculates that Perks’ motivation for becoming involved in the 1894 rescue of the LD&EC may have been driven by a desire to protect the Manchester, Sheffield and Lincolnshire Railway (MS&LR) from competition from the LD&EC’s proposed west-of-Chesterfield sections (and thus serve the interests of Perks’s close business associate Edward Watkin). This may have played a part, but the composition of Perks’ group suggests a credible alternative motivation, namely trying to replicate in another part of the UK the financial success achieved by participants in the 1887 financial rescue package for the Barry Dock and Railway Company. Wilmot described Perks as “An outsider to both Derbyshire and the coal interest”.[98] As this paper has demonstrated, the second leg of that statement is somewhat overstated.

The LD&EC did not turn out to be a second Barry. The “central section” was opened in 1897 and the railway never did reach either Lancashire or the east coast. Up to the end of 1896, dividends of 3 per cent per year were paid on the ordinary shares out of capital, as authorized by the LD&EC’s Act.[99] Once the railway was opened, no further dividends were paid. Those in Perks’ group who took advantage of the right to convert into debentures would have been protected from the consequences of that poor performance. By the end of 1905 the LD&EC board were seeking to negotiate terms for the enterprise to be taken over by a larger railway company. Terms were eventually agreed with the Great Central (formerly the MS&LR) whose chairman was by then Alexander Henderson. Perks remained on the Board of the LD&EC until the takeover was formally effected on 1 January 1907. Neither the Crane biography nor Notes for an Autobiography make any mention of the LD&EC Railway.

A railway project that was also intended to be of coast-to-coast nature was behind the registration by Fowler Perks and Co. of the “Malay Railways and Works Construction Company Limited” in February 1892 (see entry 12 in Appendix A). In March 1891 it had been announced that the King of Siam had granted a concession to Charles Dunlop of Singapore to construct a railway across the neck of the Malayan Peninsula from Singora on the east coast to link with the port facing Penang in the west.[100] This railway, it was claimed, would accelerate the mail service from Europe to the Far East by “several days … as against the long detour via Singapore” and would also attract substantial local traffic: “The line is to follow what has always been a frequented trade route across the Peninsula and … the traffic now existing along the route is … quite sufficient to make the railway an undertaking of sound promise”.[101] In February 1892 Perks registered this UK company to take over the concession from Dunlop for a mix of cash and vendor’s shares, with the company’s ₤4,500 of “seed capital” coming from Perks and his brothers-in-law John Lees Barker and William Mewburn junior (see Appendix A).

In February 1895 it was reported that construction of the line was about to start: “the interests of the syndicate are represented in London by the powerful financial firm of Messrs Fowler, Perks and Hopkinson. The Mr Fowler of this well-known firm is Mr H.H. Fowler, MP, who is in the present Cabinet as Secretary of State for India”.[102] An article in The Engineer in July 1895 described the project in some detail, including providing a map, and said “ground has been broken by the engineers responsible for the railway’s construction (Messrs. Swan and Maclaren, of Singapore and Penang).[103] But that seems to have been as far as this project got. At this stage it is not clear why, but it appears the Siamese government refused to provide any interest guarantee on capital raised to construct the line.[104] and such a guarantee may have been a sine qua non for a successful capital raising for the project.

The New Dominion Syndicate Limited (see entry 23 in Appendix A) was a second company registered by Perks as a UK corporate vehicle for promoting a transport infrastructure project overseas, in this case in Canada. The project was the Georgian Bay Ship Canal. If constructed, it would have provided access from Montreal to the upper three of the Great Lakes for ocean-going ships via Ottawa and into the eastern part of Lake Huron (the Georgian Bay), bypassing, so-to-speak, the lower two of the Great Lakes and Toronto. Compared with the subsequently-constructed St Lawrence Seaway route, it would have been “all-Canadian” rather than a co-operative venture with the United States (important for Perks’ Liberal Imperialist allies in politics) and would have sidestepped any need for engineering work in the very hard rock through which the St Lawrence flows between Lake Erie and Montreal. During the ten years or so preceding World War One, promotion of this scheme became a central focus of Perks’ business activities and was cited by him as his principal reason for not seeking to stand again for re-election at the end of the Parliament of 1906 to 1910.[105] The Crane biography devotes four pages to this scheme (pp 86-89) and Notes for an Autobiography similar. In the latter Perks describes this as “the greatest business mistake of my life” but maintains “When this canal is built, as it most certainly will be, it will rank alongside the great canals of the world”.[106] This project, like the trans-Malayan railway scheme, seems to have hit a brick-wall of private-capital-market resistance towards lending into such a project without government interest guarantees.[107]

This unhappy experience with the Georgian Bay canal did not occur until well beyond the segment of Perks career being focussed upon in this paper. By the beginning of the 1900s, Perks appears to have established a reputation for shrewdness in being able to put together financing packages for transport infrastructure projects. In May 1903 he gave evidence before the House of Lords committee on the Maryport Harbour Bill.[108] Under cross-examination he said no when asked if he was a promoter named in the Bill. He answered yes when asked “Have you been approached with regard to finding capital for the scheme?”.[109] The essence of Perks’ testimony was that the capital for this project could be raised. Counsel for the company’s promoters began a question sequence seeking to demonstrate Perks’s expertise in providing such testimony. One of the KCs opposing the Bill cut short that sequence stating: “I do not think any of us will impugn Mr Perks’s experience.” Perks went on to state that “some time ago” another project in the same region, this time for a dock at Workington, had been “submitted to my friends and to myself.” Perks said he had gone into the details of that project but had concluded: “that it was financially a very poor proposition”.[110]. These pages of Private Bills Evidence, together with the facts presented earlier in this section, suggest that it was a recurring feature of Perks’s business activities during the late 1880s and 1890s that he be approached by persons seeking to obtain finance for transport infrastructure projects, that he devote time and energy to the assessment of the “financials” of such projects, and that where such assessment proved positive, he devote time and energy to designing financing packages which provided finance for the project promoters while at the same time ‘safeguards’ for those committing private capital into the projects.

The two West African gold mining companies promoted by the Fowler-Perks firm, in November 1895 and March 1897 respectively, are of particular significance because they represent the earliest tangible evidence of business collaboration between Perks and his first-cousin Murray Griffith (see entries 17 and 20 in Appendix A). Murray Griffith (1853-1937) had been a member of the London Stock exchange since 1877 and for many years worked in the “Home Rails” section of the market.[111] During 1894 and onwards he was a major jobber in the booming market for West Australian gold-mining shares, and was for at least several years closely associated with Whitaker Wright[112]. It was probably money Griffith made from trading in Australian gold company shares that enabled him to become “well-known as an owner of racehorses”.[113] It is known that Griffith was involved in major purchases of shares in the Metropolitan District Railway Company (MDR) during 1896.[114] In August 1898 Perks attended the MDR half yearly general meeting, stated that he held £100,000 in ordinary shares in the company and advocated the appointment of the two new directors to the MDR board (Murray Griffith and Paul Speak).[115] This resolution was defeated. But from this time at least it would seem reasonable to think that Perks was putting energy into working-up a financing package for converting the Inner-Circle of the London Underground to electrical traction.

In June 1901 J.S. Forbes, the erstwhile controlling figure of the MDR, announced that “[Mr Perks and the gentlemen associated with him] had bought an enormous percentage of the ordinary share capital and they were now masters of the situation”.[116] In August 1901 both Perks and Griffith became directors of the MDR. On 5 Sept 1901, Perks became chairman. Griffith subsequently became a founder director of the Metropolitan District Electric Traction Company Limited (see entry 25 in Appendix A). That company upon its foundation took over ownership of the controlling shareholding interest in the MDR that had been accumulated by the group associated with Perks and Griffith.[117] Griffith remained a director of the MDR until ownership passed to the public sector in 1933. In Notes for an Autobiography no direct mention is made of Murray Griffith, although Perks does describe holidaying in Winchelsea with his Griffiths cousins in his youth, and to sharing with them the view that their Uncle Charles should have directed more of his money towards his heirs rather than towards adorning the new Anglican Cathedral in Melbourne.[118]

The Barry Estate Company is not the only company appearing in Appendix A that represents an “interface” between the property development strand of Perks’ business activities and his company promoting. For a coherent account of Perks’ property development activities, much additional research will be necessary. What follows simply attempts to summarize some of the features that are thus-far apparent. Crane’s biography dates Perks’s activities in this field back to the mid 1870s when “some of the large estates which are now covered with thriving metropolitan suburbs were only just beginning to be laid out for building purposes. Sir Robert … interested himself to advantage in some of the more promising schemes. He also made some judicious deals in house property, occasionally reselling his purchases at a profit without having so much as seen the deeds”.[119] Notes for an Autobiography is silent on property development activities in London (and Barry) but makes an interesting hint at Perks’ interest in such activity in selected seaside resorts. Around 1878 Perks was doing some work for the Marquis of Bristol “to help him with a perfectly hopeless railway scheme in the Eastern Counties.” Perks states: “I remember at one time advising him strongly to sell all his farms in the Eastern Counties which were then selling at prodigious fancy prices, and to invest the proceeds in the purchase of shop properties in the seaside towns on the South Coast, especially Hastings, Folkestone, Brighton and Eastbourne. I advised him to select properties on the seafront”.[120]

The Diaries of one of Perks’s third-cousins in Wolverhampton, John Hartley Perks (1841-1912) have survived in Wolverhampton Archives. For 24 January 1878, J.H. Perks records: “called on Robert Perks and lunched at the city club with him. Inspected some property where we intend having a joint little building speculation”.[121] For 24 September 1878, he records: “I have entered into a scheme with Robert respecting building a warehouse in London”.[122] There is additional evidence of Perks investing in London warehouses. In 1890 Perks and three others petitioned the House of Lords against the Regents Canal City and Docks Railway (Extension of Time) Bill. The petition cites Perks to be “the owner of a large leasehold warehouse in Fann Street, held for a term of which about 66 years are unexpired” and also that Perks is joint owner with two of his co-petitioners “of two long leasehold warehouses in Brackley Street, having about 67 years unexpired”.[123] One of Perks`s co-petitioners was Henry Thomas Tubbs, who was also a director and the largest shareholder in The Littlestone Hotel Company Limited, promoted by Fowler-Perks in 1889 (see entry 5 in Appendix A), holding 2800 of the 6497 shares issued by the company.

H.T. Tubbs (1832-1918) was a silk merchant and “elastic sidespring maker”[124] who left ₤269,936 at this death.[125] One of his sons, Walter B. Tubbs, was from 1885 in partnership with Richard Stafford Charles as Charles and Tubbs, land agents, surveyors and auctioneers of Broad Street, London. After the Lydd railway’s extension to New Romney opened and provided railway access to Littlestone-on-Sea (see above), Charles and Tubbs in co-operation with the Fowler-Perks legal firm began promoting sales of building land in Littlestone. A fairly lengthy advertisement in the Times 8 September 1887 announced the auction by Messrs Charles and Tubbs, at the Station Hotel, Littlestone-on-Sea of 200 plots of “very eligible and valuable freehold building land” stating that plans etc. could be obtained gratis from Fowler, Perks, Hopkinson and Co., and that a special train would carry “purchasers and others” to Littlestone for the day, with tickets available from the auctioneers at a specially reduced fare (4 shillings).[126] Similar advertisements appeared for a second tranche of building lots in July-August 1888, also naming the two firms, and involving a special train.[127] A third tranche was advertised in March 1889, this time with a longer section extolling the positives of Littlestone and stating that sale would be “on the ten year system” and would therefore require only a 5 per cent deposit up front.[128] This was the backdrop to the flotation of the Littlestone Hotel Company. When its prospectus was published, the Financial Times reported that “Messrs Charles and Tubb, the auctioneers … have been making vigorous efforts to boom Littlestone-on-Sea by means of free luncheons etc. to the Press and others.”[129] Today’s Littlestone website states that Perks and Henry Tubbs “laid out Littlestone golf course, which became very popular with Members of Parliament and Government Ministers”. In December 1891, the Financial Times referred to golf as “Littlestone’s staple industry”.[130]

There are two other companies in Appendix A with a property-development focus: The Tower Company Limited (whose name was changed to the Wembley Park Estate Company Limited in 1906) and Metropolis Estates (see entries 4 and 26 in Appendix A). The original name of the Tower company suggests it was initially conceived that it would be the owner of the tower that Edward Watkin was enthusiastic to see built in London, and that it may or may not have been expected to act as developer of the overall site-area acquired to accommodate that new structure. The presence of TA Walker among the company’s initial seven subscribers might suggest he was intending to tender for the contract to construct the tower. Interestingly Walker did not sign the company’s memorandum of association personally. It was signed for him by Perks in his role as Walker’s attorney.[131] This suggests that Perks’ own role as an initial subscriber to the company was influenced by more than his status as solicitor to the Metropolitan Railway – an enterprise from which the Tower company’s promoters hoped to secure support, on the basis that the tower would have a location that would generate substantial new “traffic” for that Railway.

Two months after the Tower company had been registered, it apparently had still not been determined where the tower would be built, with Watkin stating: “we have bought one site and are in treaty for two others, but I cannot tell you where”.[132] The Metropolitan Railway’s Report to shareholders issued for the general meeting of 25 July 1890, stated that the tower site would be adjacent to the Railway “between Neasden and Harrow, and a special station will be built for the accommodation of visitors.” In his address to the meeting, Watkin said that the Railway had bought the land (280 acres at Wembley Park at ₤150 per acre) and was “now in treaty to place the proposed London tower [there].” He argued that the site would become the centre for the “great exhibitions” he expected would conducted in London.[133] The Tower company tried to raise capital from the public in August 1890, with preferential treatment to applications from shareholders in the Metropolitan Railway. But this does not appear to have been very successful.[134] The Company succeeded in allocating only 60,000 of its ₤1 shares. But after placing a further ₤10,000 of shares among those already its shareholders, the company purchased the land from the Railway and commenced preparatory work on the site, including the formation of a lake.[135]

In August 1891, a new company was registered by the Fowler-Perks legal firm to take over the functions of constructing and operating the proposed tower (see entry 11 in Appendix A). The “old” Tower company leased 124 acres of the Wembley Park Estate to the new, including the “almost completed foundations of the proposed tower”, on a 999 year lease at ₤2000 per year rental (from October 1892) plus a profit-sharing agreement in the event of the new company’s profits allowing it to pay dividends above 15 per cent per year to its shareholders.[136] Perks took up only 100 shares in the new company, and his family-members none. He appears to have sold those 100 in 1893. Once the new Tower company was formed, the old one became more purely a property development investment. In 1899 the ‘new’ Tower company folded and the 124 acres plus partially built tower were resumed by the ‘old’ Tower company. The partially built tower was closed to the public in 1902 and demolished in 1907. The ‘old’ company had changed its name in October 1906 to better reflect the nature of its business. Perks and his family, and the TA Walker heirs, maintained shareholdings in the ‘old’ Tower company through to 1914 and beyond. Their combined holdings accounted for slightly over 5 per cent of the company’s ordinary share capital in December 1899.

The Metropolis Estates Company Limited (entry 26 in Appendix A) was a much more conventional property development business, and with a focus on London. Indeed its principal focus was a particular “corner” block of land in Southern Kensington bounded by Thurloe Place on the north-side and Brompton Road on the eastern-side.[137] The corner “points” towards the site upon which was built the Brompton Road station of the Piccadilly Line (opened December 1906, closed July 1934). A set of leaseholds covering this corner block area had been granted in 1826 and were due to expire together in a block in 1906.[138] The shareholdings in Metropolis Estates at the end of 1902 seem to fall into three groupings, each represented by one of the company’s three directors. A quarter of the company’s capital was held by Perks plus three of the four married daughters of the deceased TA Walker: Fanny Walker, Alice Maud Abbott, and Anne Ellen Cropper (these three having 5000 shares each). A quarter was held by Walter Abbott, of Boston Massachusetts, who was a founder director of the Metropolitan District Electric Traction Company (see entry 25 in Appendix A), which took control of the statutory companies authorized to construct what became the Piccadilly Line in September 1901.[139] No family connection has been established between Walter Abbott of Boston and Alice Maud’s husband William Frederick Abbott. A further five percent was held by Gordon Abbott, “banker” of Ames Buildings Boston.[140] The remaining 45 per cent of Metropolis shares were represented by four holdings: the Merchant Bank Speyer Brothers (38.9 per cent); W.H. Brown, who was one of the partners in that bank; the bank’s solicitors; and Charles A. Spofford “C/o Speyer Bros, NY”.[141] C.A. Spofford (1853-1921) was a director of Metropolis Estates. His New York Times obituary in 1921 stated that in 1902 he had gone to London to represent American interests in Yerkes’ underground railway project there.[142]

Fanny Walker was the second oldest of T.A. Walker’s four daughters. In August 1883 she married her first-cousin Charles Hay Walker, the elder son of T.A. Walker’s brother and business partner Charles Walker, who had died in December 1874.[143] Perks acted as legal advisor to the executors of the T.A. Walker estate and advised that the best way of handling the set of very substantial transport infrastructure contracts that Walker had been engaged in at his death, was to apply for a Private Act of Parliament.[144] The first Walker Estate Private Act of 1891 was followed by a second in 1894. These allowed the TA Walker executors to manage the Walker enterprise as a trust without any pressing need for a new corporate structure until 1898.[145] In 1897, the Buenos Aires dock project as originally conceived was finally completed and the project’s financing arrangements needed to be wound-up. Thus at the Buenos Ayres Harbour Works Trust general meeting of March 1896 it was stated that this trust would be terminated “in the first months of 1898”[146] This coincides with the registration of CH Walker and Company Ltd (see entry 21 in Appendix A), in which Perks states “The Share Capital … was subscribed by Mr C.H. Walker and by me.”[147] The CH Walker Company was the main enterprise with which Perks sought to have his name associated, until he parted from that company in 1912[148]. Beyond that point, he did however maintain co-shareholding relationship with the TA Walker heirs in the three main property-development companies discussed above.

Concluding Comments

The principal intention of this paper has been to demonstrate that during the time preceding Perks becoming joined with C.T. Yerkes in the electrification of, and construction of significant extension to, the London Underground from 1900, Perks’s business career had not been confined to that of “railway solicitor” – the picture presented by the existing principal sources re. Perks. It is well-established that Perks worked “in connection with” the high-profile transport-infrastructure contractor Thomas Andrew Walker from around 1880. But is has been easy for historians, in the absence of other evidence, to interpret that Perks’s “connection” with Walker (and his heirs) represented little more than a supply of solictors’ services, and to describe Perks as simply a solicitor with a specialization in railways etc.

This paper has presented evidence that that traditional or “accepted” picture of R.W. Perks tends to misrepresent his business activities. It has been argued that two substantial strands in Perks’ business career are overlooked in that “accepted” picture of Perks. One of those two strands is Perks’s activities as a property developer. The evidence presented here is suggestive and requires more research. But the evidence regarding Perks’s activities as a successful organizer/facilitator of financing packages for ventures (principally transport infrastructure projects) would appear to be strong. I contend that this evidence should lead to a re-evaluation of Perks’s role in British business and finance in the period of the late 1880s to early 1900s. To quote from the Methodist Recorder of 1907: “Mr Perks is sometimes described, not only in Methodist circles, but in the Public Press as simply a lawyer … The greater part of Mr Perks’ life, and his most successful work … has not been spent in the law, but in constructing great Railways, Docks and Harbours in various parts of the world”.[149]

[1] See Charles E Lee, “Perks, Sir Robert William (1849-1934)” in David J. Jeremy (ed.) Dictionary of Business Biography, Butterworths, London, 1985, volume 4, pp 628-632; TC Barker and Michael Robbins, A History of London Transport, volume 2, George Allen and Unwin, London, 1974, Chapters 3 and 4 (pages 56 and 62-63 in particular); A.A. Jackson and D.F. Croome, Rails Through The Clay, George Allen and Unwin, London, 1962, Chapters 4 and 5 (pages 64-65 in particular); David J. Jeremy, Capitalists and Christians, Clarendon Press, Oxford, 1990, p 301 and ff. These and the various other more recent references to Perks rely heavily on four main sources: Denis Crane, The Life Story of Sir Robert W Perks, Baronet, MP, Robert Culley, 1909; R.W. Perks, Sir Robert Perks, Baronet, Epworth Press, 1936 (henceforth referred to as Notes for an Autobiography); Perks’s final entry in Who’s Who (1934) which then became his entry in Who Was Who 1929-1940; and O.A. Rattenbury, “Perks, Sir Robert William”, in L.G. Wickham Legg Dictionary of National Biography, Supplement 1931-40. Oxford University Press, Oxford, 1949, pp 687-8. “Denis Crane” was the pen-name of Walter Thomas Cranfield who was a journalist with The Methodist Recorder. Perks’s father had been a founder director of that newspaper and Perks was chairman of its Board of Governors (see pp 4-5 of Owen Covick, “R.W. Perks, C.T. Yerkes and Private Sector Financing of Urban Transport Infrastructure in London 1900-1907”, paper presented to the 2001 Conference of the Association of Business Historians, Portsmouth, June 2001.)

[2] “Perks agitated for years for the organic union of the three larger Methodist Churches and worked skilfully for its consummation. When this was accomplished in 1932 he was elected unanimously as the first vice-president of the united body”. (Rattenbury, op cit, p 688). See also the entry on Perks (written by John Lenton) in John A. Vickers (ed) A Dictionary of Methodism in Britain and Ireland, Epworth Press, Peterborough, 2000.

[3] Crane, op cit, p 215. Perks was ousted from this role in 1907 by the Baptist MP for North-West Norfolk, Sir George White. See p 327 of Barry M. Doyle “Modernity or Morality? George White, “Liberalism and the Nonconformist Conscience in Edwardian England”, Historical Research, vol 71, October 1998, pp 324-340.

[4] Stephen Koss, “Wesleyanism and Empire”, The Historical Journal, vol 18, 1975, pp 105-118. The passage quoted is at pp 108-9. A.G. Gardiner, in his 1923 biography of Sir William Harcourt, quotes the then parliamentary leader of the Liberal party as referring to the pro-Rosebery group as “the Perks and H. Fowler gang”, “the Perks conspiracy” and “the Perksites” (pages 519, 524 and 534/537 respectively of A.G. Gardiner, The Life of Sir William Harcourt, Constable and Co., London, 1923).

[5] Methodist Times, 8 February 1894, p 83. The piece includes a line-engraving of Perks (head and shoulders).

[6] See F.H.W. Sheppard (ed). Survey of London, volume 37, Northern Kensington, Athlone Press, London, 1973, p 166.

[7] Financial Times, 27 May 1892, p 3. (See also ibid 23 May 1892, p1).

[8] Survey of London, vol 37, p 166.

[9] Dod’s Parliamentary Companion, 1894 edition, p 321; and 1893 edition, p 321. Perks lived at 11 Kensington Place Gardens until his death. In 1936, his son sold the Crown lease to the Duke of Marlborough. (Times, 19 November 1936, p 9)

[10] Mark Girouard, “Town Houses for the Wealthy” Country Life, 11 November 1971, pp1269-71; and “Gilded Preserves for the Rich” Country Life, 18 November 1971, pp1360-63. The quotation is from p 1361.

[11] Survey of London, vol 37, p 161.

[12] Kelly’s Post Office Directory for 1894. Figures for estates at death are taken from D.J. Jeremy

Dictionary of Business Biography, for those with entries therein.

[13] See entry for Percy Burnell Tubbs in Who Was Who 1929-1940. The list includes “both sides of Paper St and Cotton St, City; 6, 7, 10 and 11 Barbican … The Assembly Hall [and] The Grand Hotel [at Littlestone]”.